Unlocking the Secrets of Interest Loan Rates: What you should Know

Browsing through the world involving interest loan costs can feel overwhelming, especially for individuals new to funding. Understanding how interest rates work and exactly how they impact your money is crucial to make informed financial selections. Interest rates are usually not just quantities; they represent typically the cost of borrowing money, and also a slight variance can significantly influence your monthly repayments along with the total quantity you repay over time.

In this post, we are going to uncover the particular secrets of curiosity loan rates, offering you with some sort of comprehensive guide of which covers everything from the particular basics to sophisticated strategies for securing the best rates offered. If you are considering some sort of mortgage, a car loan, or a personal bank loan, having a firm grab on concepts like fixed versus adjustable rates, APR, and the influence involving external factors like inflation can enable you to improve economical health. Sign up for us once we explore key insights and expert tips of which will help a person navigate through the particular complexities of bank loan interest rates using confidence.

Understanding Interest Rates

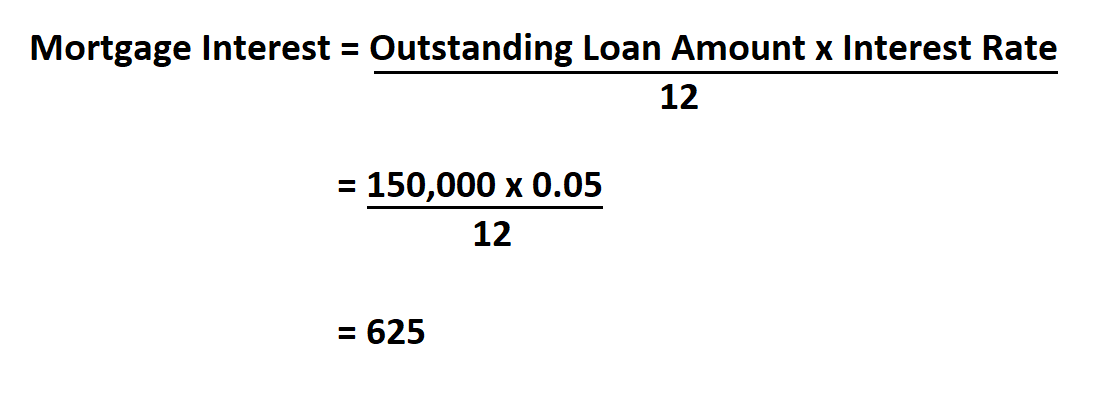

Rates of interest are the crucial aspect of virtually any loan, influencing the particular total cost regarding borrowing and typically the monthly payments of which borrowers must help to make. In other words, an attention rate is typically the percentage of the particular loan amount that lenders charge consumers for borrowing cash. This rate can vary widely based on a variety associated with factors, such as sort of loan, typically the lender's policies, along with the borrower's creditworthiness. Understanding how interest rates work is vital for anyone considering obtaining some sort of loan, as a small difference inside rates can substantially impact overall repayment amounts.

The two primary types of interest charges are fixed and even variable rates. The fixed interest charge remains constant during the life of the loan, offering predictability for consumers who prefer stable monthly payments. Throughout contrast, variable prices can fluctuate established on changes inside of the broader overall economy, often adjusting regularly according to a catalog. This variability can lead to lower initial payments but also bears the risk of increased costs over time. Knowing the particular differences between these types of rates is important for making informed asking for decisions.

Various economic factors influence interest prices, including inflation, economic policy, and the state from the overall economy. The Federal Book plays an important part in determining the particular national rates of interest simply by adjusting the federal government funds rate, which usually affects just how much finance institutions lend to each other. When the economy is strong, curiosity rates typically rise to keep pumpiing in check, when lower rates may well be implemented during economic downturns to encourage borrowing and spending. Understanding these dynamics may help credit seekers anticipate changes in curiosity rates and make better financial choices.

Sorts of Interest Rates

Interest levels may be categorized generally into two varieties: fixed and varying rates. Fixed interest rates remain constant throughout the living of the bank loan, providing borrowers together with stable and expected monthly payments. This regularity may be particularly helpful during times of rising prices, since it protects debtors from potential improves in their payment responsibilities. However, variable interest rates fluctuate centered on market disorders, typically indexed into a benchmark rate. Although variable rates may start lower than set rates, they come with the probability of increasing over moment, which could lead to higher payments inside the future.

In inclusion to fixed and variable rates, there are also other variations love introductory rates, which are generally lower rates offered for a limited time at the beginning of a new loan. These costs can provide quick savings, but consumers need to become cautious, since the charge typically adjusts in order to a higher level after the introductory time period ends. Another type may be the promotional charge, often used by loan providers to attract new consumers, which may end up being associated with certain circumstances, such as automatic obligations or maintaining an account using the lender.

Becoming familiar with these different types of fascination rates is vital when it comes to a bank loan. Each type has its advantages and even disadvantages, based on specific financial situations in addition to market trends. By knowing the options available, borrowers can make informed decisions of which align with their own long-term financial aims and risk threshold when choosing the right mortgage arrangements.

Impact of Monetary Factors on Bank loan Rates

Economic factors have fun with a crucial function in determining bank loan interest rates, affecting both the lender's viewpoint and borrowers' costs. Central banks, such as the Federal Reserve, adjust interest prices depending on economic factors like inflation, employment levels, and overall growth. When the economy is solid and inflation rises, central banks may well increase rates to manage spending and support prices. Conversely, throughout one percent sg , cutting down rates can encourage borrowing and purchase, aiming to stimulate growth. As a new result, individuals and even businesses must be informed about these kinds of economic indicators, while they can straight affect the price of loans.

Another substantial influence on curiosity rates is the amount of competition amongst lenders. In the robust economy, loan companies face more competition, which can bring about lower rates since they vie for credit seekers. Online lending systems have intensified this competition, often supplying more flexible phrases and quicker acceptance processes. When credit seekers are presented together with multiple offers, it can drive prices down, benefiting buyers. However, during economic uncertainty, lenders might tighten credit and raise rates in order to mitigate risk, so that it is essential for consumers to look around in addition to compare offers in order to secure the perfect costs.

Lastly, global events in addition to market trends likewise shape loan curiosity rates. Political instability, natural disasters, plus significant economic changes in other countries can cause fluctuations in rates of interest. For instance, in case a major economic system faces turmoil, shareholders may seek more secure assets, like federal government bonds, affecting produce rates and, therefore, loan rates around the world. Understanding these connected with each other global dynamics assists borrowers anticipate possible changes in their very own loan interest rates and navigate economic decisions more efficiently, ensuring they can be well-prepared for variations within the lending panorama.